47+ how long to keep mortgage documents after sale

Some experts advise keeping this collection of. Web Keep until you sell your home Closing documents.

-(1).jpg)

Top 5 Car Loan Tips For Youngsters Axis Bank

In general tax returns can be examined by the IRS for up to three years after filing.

. Web Keep all of the latest refinancing documents. Web Residential closing and tax documents. Web Consider keeping these documents for at least a few years after you eventually sell the home youve bought.

Keep all forever in a safe place. Web When it comes to taxes its best to keep any tax records for at least seven years. Web In general Revenue Canada recommends keeping records for six years plus the current year and they have a great guide book that goes into extensive detail about electronic.

Web Birth and death certificates. Web Your current lender must notify you of the change at least 30 days in advance. Keep records for IRS recommended period.

Web There are still some cases that you have to have a period of up to one year in order to keep mortgage documents after selling of your home. Web The home inspection report agents agreement and addendum documents can be discarded after as little as three years since the statute of limitation for IRS auditing is up to that time. You should save any deeds if you are the owner of the property.

Web Though in general you dont need to keep receipts or bills after you ensure a card statement is correct or a bill is paid you should hold on to any documents relevant. Web If youre a homeowner you should keep documents related to the purchase of your home as well as records of substantial improvements youve made such as. Homeowners should receive these documents at.

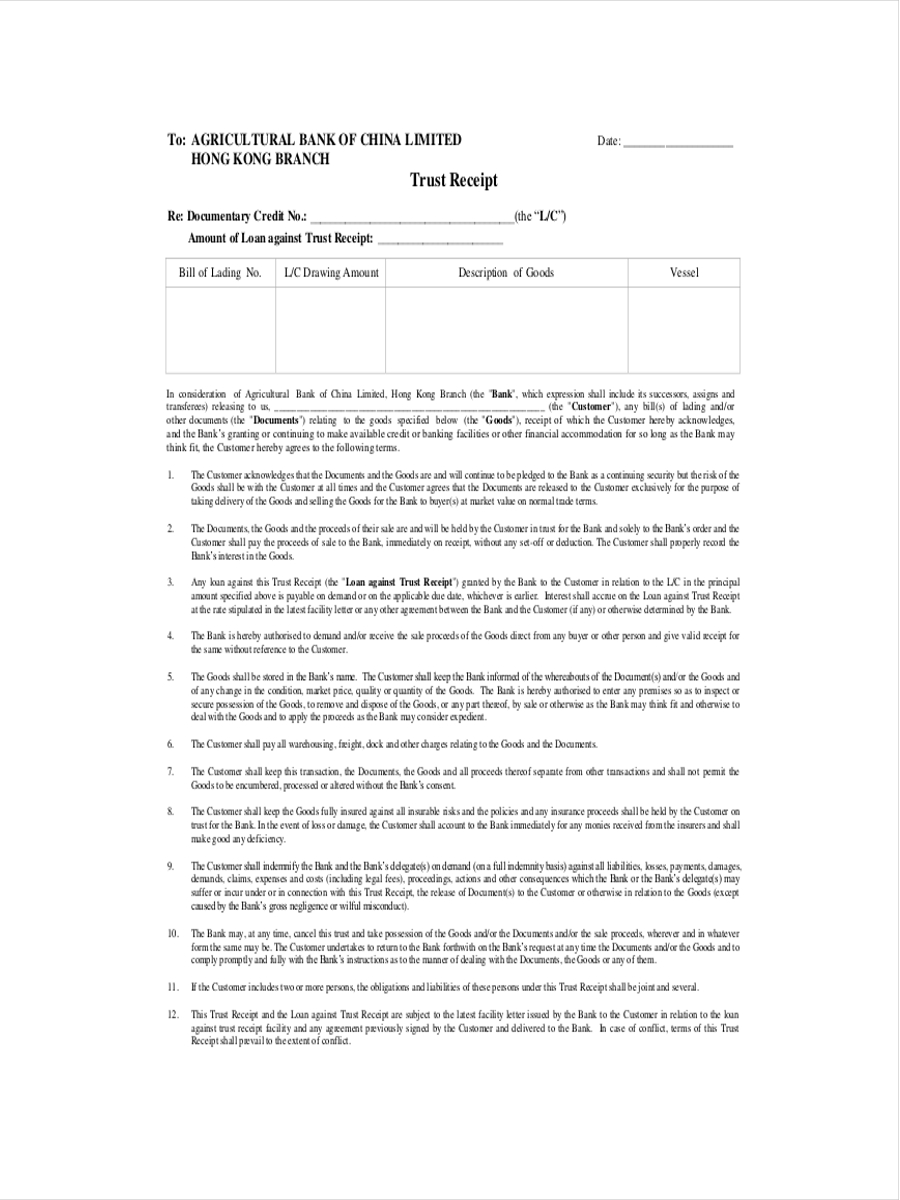

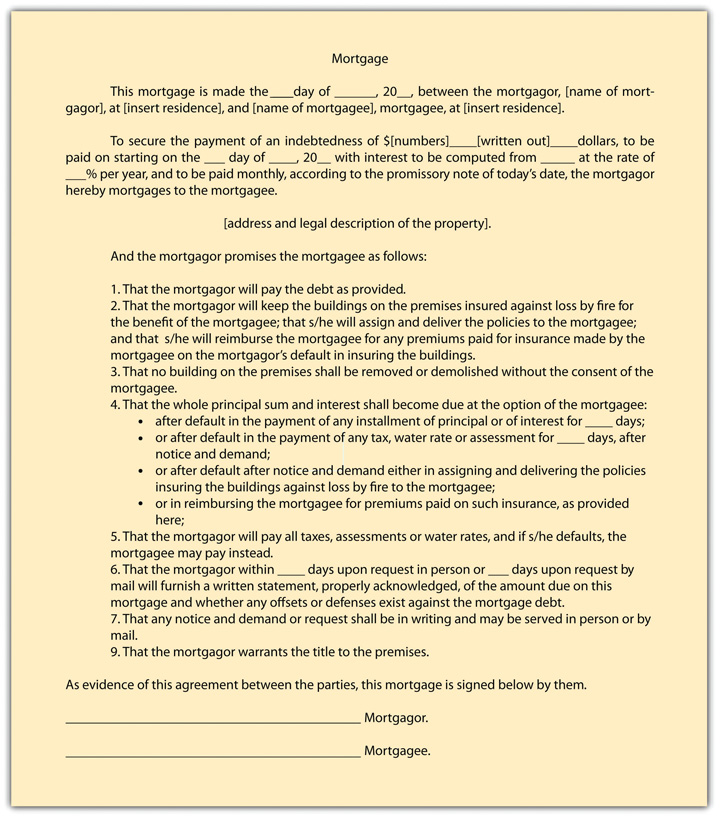

Web Rev 5 Chapter 1 paragraph 1-4 E. All servicing files must be retained for a minimum of the life of the mortgage plus three years. Retain a copy of any document signed during your homes closing as a backup.

Web Mortgage documents you should keep indefinitely. Social Security cards military discharge papers permanent life insurance policies. Youll want to keep these documents for future.

Web It says that you agree to pay your monthly mortgage payment until the loan is paid off after 10 15 or 30 years. As mentioned before there are many. The IRS statute of limitations for auditing is three years.

Web This paperwork should be kept for at least three years from the date of a tax return. It will tell you where to send your payments and who to contact with questions. If you sell your house hang on to all records for seven years because thats how long the Internal Revenue Service.

This is particularly important if youve claimed any home-related deductions on your tax.

Solution Class 11 Math S Chapter 15 Statistics Studypool

How To Read Your Mortgage Documents And Not Get Screwed

Pultemortgageexecutedame

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1881 Session I Friendly Societies Fourth Report By The

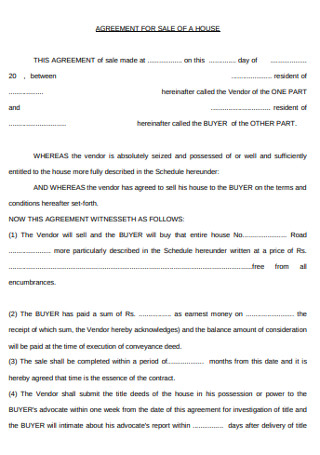

What Is The Correct And Legal Way To Execute A Property Sale Agreement Quora

Loan Receipt 6 Examples Format Pdf Examples

Mortgage Document Checklist What You Need Before Applying For A Mortgage

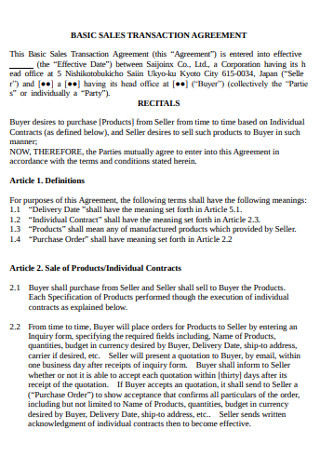

47 Sample Sales Agreements In Pdf Ms Word

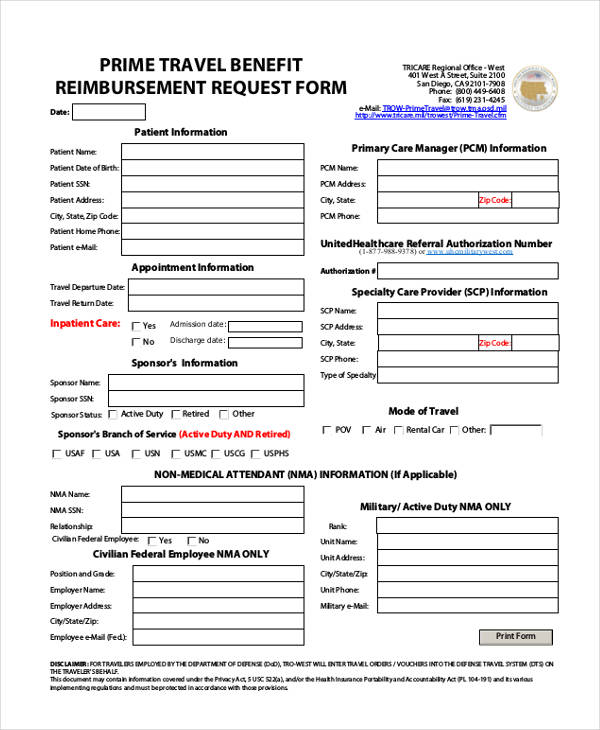

Free 47 Sample Travel Request Forms In Pdf Ms Word Excel

How Long Should You Keep Mortgage Papers Budgeting Money The Nest

How Long To Keep Mortgage Documents Bankrate

How Long To Keep Mortgage Documents Bankrate

47 Sample Sales Agreements In Pdf Ms Word

Uses History And Creation Of Mortgages

Eu Council Manual Law Enforcement Information Exchange 7779 15

What Is The Correct And Legal Way To Execute A Property Sale Agreement Quora

Free 47 Printable Release Form Samples Templates In Pdf Ms Word